Are you intrigued by the prospect of diving into the world of real estate investment? Are you eager to bolster your financial portfolio and generate steady cash flow? Real estate can indeed be a lucrative avenue for wealth accumulation, offering a plethora of opportunities for savvy investors. However, before delving into the realm of property investment, it’s crucial to understand the various strategies available and the associated risks and rewards. In this guide, we’ll explore two prominent real estate investment strategies tailored to the Kenyan context: fix and flip, and buy and rent.

- Fix and Flip: Turning Properties into Profits

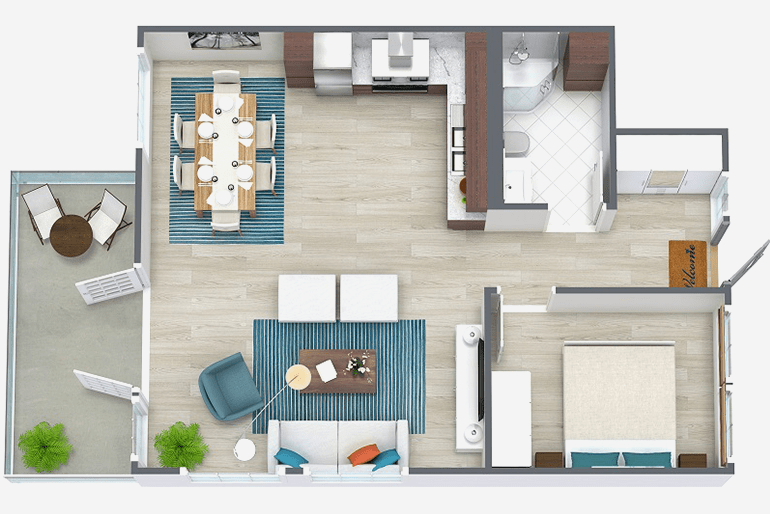

The fix-and-flip strategy involves purchasing off-plan concepts or distressed properties, renovating them, and selling them for a profit. This approach can yield substantial returns if executed effectively. However, it’s essential to weigh the advantages and drawbacks before diving in.

- Advantages of Fix and Flip:

Distressed properties, such as foreclosures, are often sold below market value, minimizing upfront investment requirements.- Quick Returns: With efficient renovations, investors can swiftly turn around properties and realize profits within a short timeframe.

- Minimal Landlord Responsibilities: Unlike long-term rental properties, fix-and-flip investments don’t entail ongoing landlord duties, such as tenant management.

- Potential Challenges of Fix and Flip:

- High Transactional Costs: Renovations and repairs can incur significant expenses, impacting overall profitability.

- Unforeseen Complications: Zoning issues, permit delays, or unexpected repairs can disrupt timelines and escalate costs.

- Market Volatility: Fluctuations in market conditions may affect property values and resale potential, posing risks to investors.

- Advantages of Fix and Flip:

- Buy and Rent: Building Passive Income Streams

Alternatively, the buy-and-rent strategy involves acquiring properties and leasing them out to tenants, generating a steady stream of rental income over time. While this approach offers long-term wealth-building potential, it comes with its own set of considerations.

- Advantages of Buy and Rent:

- Steady Income Stream: Rental properties can provide reliable monthly cash flow, covering expenses and generating passive income.

- Long-Term Appreciation: Real estate historically appreciates over time, offering the potential for capital appreciation and wealth accumulation.

- Diversification of Portfolio: Rental properties offer diversification benefits, complementing other investment assets and hedging against market volatility.

- Potential Challenges of Buy and Rent:

- Maintenance Responsibilities: Landlords are responsible for property maintenance, repairs, and tenant management, which can be time-consuming and require hands-on involvement.

- Capital Lock-In: Unlike fix-and-flip investments, buy-and-rent properties involve long-term commitments, tying up capital and limiting liquidity.

- Tenant Risks: Finding and retaining quality tenants, addressing rental defaults, and managing tenant disputes are ongoing challenges for landlords.

- Advantages of Buy and Rent:

Ultimately, aspiring real estate investors in Kenya have a myriad of opportunities at their disposal, from fix-and-flip ventures to long-term rental properties. However, navigating the complexities of the real estate market requires careful consideration and strategic planning. Whether you’re drawn to the potential windfalls of flipping properties or the steady income streams of rental properties, it’s essential to conduct thorough research, assess your risk tolerance, and seek guidance from seasoned professionals.

At Linda Mokeira Real Estate, we specialize in assisting aspiring investors in navigating the dynamic Kenyan real estate market. With our expertise and personalized guidance, you can confidently pursue your real estate investment goals and unlock the full potential of property investment in Kenya. Contact us today to embark on your journey to real estate success and secure your financial future.